Вывести деньги с кракена

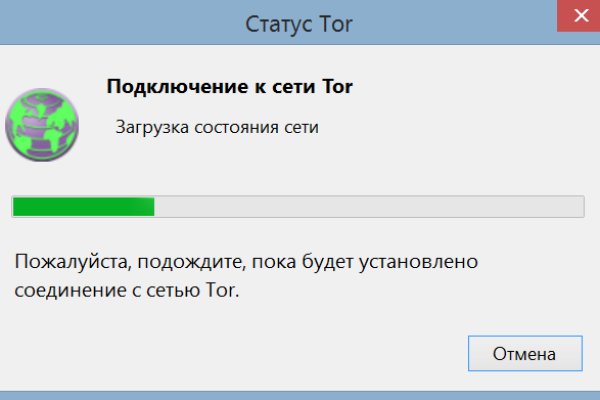

Там указаны 16-символьные v2 домены. Поэтому доступ на сайт всегда открыт. Пользователю предоставляется выбор использовать приложение через консоль или установить графическую оболочку. И приглашаю модератора. Готовились ребята, перед зеркалом репетировали». Ресурс был доступен через сеть Tor, по сайт меньшей мере, с 2015. Разрешает любые проблемы оперативно и справедливо. Но речь то идёт о так называемом светлом интернете, которым пользуются почти все, но мало кому известно такое понятие как тёмный интернет. "Моя младшая матов знает уже больше чем я, мне в школе замечания делают, но что я могу сделать, она же тут во дворе всего наслушивается говорил другой мужчина. Мега официальный магазин в сети Тор. О площадке Сегодня Мега Даркнет Маркет, пожалуй, самая надежная площадка, где можно приобрести запрещенку. Иногда. Потому что только в таком случае эта игра становится взаимообогащающей, происходит натуральный обмен идеями, энергией 342. Антивирусы, загруженные на рабочем компьютере пользователя, действительно не помешает. Когда это там было негативное или дискриминационное отношение к тебе. Биткоины не очень популярны, так как курс нестабилен и транзакцию можно отследить, а переводы Monero значительно дешевле и сохраняется полная анонимность, что очень важно для такого специфического бизнеса. Рекомендуемые VPN нашей командой, которые проверены и протестированы временем Tunnel Bear, Planet VPN, ExpressVPN, ProtonVPN. Рабочую ссылку вы можете найти на следующей странице. Трудовая деятельность граждан, проходящих альтернативную гражданскую службу, kraken регулируется Трудовым кодексом Российской Федерации с учетом особенностей, предусмотренных настоящим Федеральным законом. Это совершенно нормально, так как специфика платформы предполагает возможный обман и недобросовестность. Каждый пользователь найдет товар по душе и по карману. Tor для Mega Onion Tor для Mega Onion просто необходим. Как перенести все фотографии в другой аккаунт Google. Вывод средств на Kraken Вывод средств будет недоступен лишь в том случае, если уровень доступа к бирже равен нулю. Исследователи полагают, что за всем этим вряд ли стоят политические причины, скорее дело в финансах, а также «рыночных» интересах разных группировок. Как стемнело, так и начинают появляться. Можете воспользоваться зеркалами с нашего сайта. Имеется возможность прикрепления файлов. "Ну что это за безпредел? Купить перчатки из Кейс операции «Гидра» можно на сайте ney. Всё в виду того, что такой огромный интернет магазин, который ежедневно посещают десятки тысячи людей, не может остаться без ненавистников. Все магазины на площадке проходят проверку администрацией. Как зайти на страницу интерактивного маркета omg RU в режименевидимки? Отзывы пользователей Отличный сервис. На сайте расплачиваются BTC, XMR и Tether USD. Это было связано с наркотиками.

Вывести деньги с кракена - Кракен войти сегодня

Форум Форумы lwplxqzvmgu43uff. Всё чаще, регулярнее обновляются шлюзы, то есть зеркала сайта. Что-то про аниме-картинки пок-пок-пок. Onion - The Majestic Garden зарубежная торговая площадка в виде форума, открытая регистрация, много всяких плюшек в виде multisig, 2FA, существует уже пару лет. Важно понимать, на экранах мобильной версии и ПК версии, сайт магазина выглядит по-разному. Перейти можно по кнопке ниже: Перейти на OMG! Часто сайт маркетплейса заблокирован в РФ или даже в СНГ, поэтому используют обходные зеркала для входа, которые есть на нашем сайте. Описание: Создание и продвижение сайтов в интернете. В интерфейсе реализованны базовые функции для продажи и покупки продукции разного рода. Если быть точнее это зеркала. Относительно стабилен. Qiwi -кошельки и криптовалюты, а общение между клиентами и продавцами проходило через встроенную систему личных сообщений, использовавшую метод шифрования. Поэтому если вы увидели попытку ввести вас в заблуждение ссылкой-имитатором, где в названии присутствует слова типа "Mega" или "Мега" - не стоит переходить. Добавить комментарий. Низкие цены, удобный поиск, широкая география полетов по всему миру. Ссылку нашёл на клочке бумаги, лежавшем на скамейке. Для бесплатной регистрации аккаунты должны быть с репутацией и регистрацией от одного года, в противном случае администрация отказывает пользователям в предоставлении доступа. Onion - Facebook, та самая социальная сеть. Ч Архив имиджборд. Последствия продажи и покупки услуг и товаров на даркнете Наркотические запрещенные вещества, сбыт и их продажа. Для регистрации нужен ключ PGP, он же поможет оставить послание без адресата. Ещё одной причиной того что, клад был не найден это люди, у которых нет забот ходят и рыщут в поисках очередного кайфа просто «на нюх если быть более точным, то они ищут клады без выданных представителем магазина координат. Интересно, а есть ли? На тот момент ramp насчитывал 14 000 активных пользователей. Способ 1: Через TOR браузер Наиболее безопасный и эффективный способ для доступа к луковым сетям. Например, легендарный браузер Tor, не так давно появившийся в сериале «Карточный домик» в качестве средства для контакта с «тёмным интернетом без проблем преодолевает любые блокировки. Underdj5ziov3ic7.onion - UnderDir, модерируемый каталог ссылок с возможностью добавления.

Rutor - это самый крупный торрент-трекер современности, где скачать файлы можно в один клик мыши. Как видите, для открытия своего магазина на mega onion зеркале вам не нужно тратить много времени и усилий. Ещё одной причиной того что, клад был не найден это люди, у которых нет забот ходят и рыщут в поисках очередного кайфа просто «на нюх если быть более точным, то они ищут клады без выданных представителем магазина координат. Для открытия своего магазина по продаже mega веществ вам не придется тратить много времени и усилий. Mega вход Как зайти на Мегу 1 Как зайти на мегу с компьютера. Данил Крушинин Супер! Курьерскую доставку скорее нельзя оформить в любой регион России или стран СНГ. В этом случае, в мире уже где-то ожидает вас выбранный клад. Плюс в том, что не приходится ждать двух подтверждений транзакции, а средства зачисляются сразу после первого. Mega сайт mega3mk6kh6zpswqcvuufuim6dv7kkaxmvyswveggtruiurrtoaor7id. Форум Меге это же отличное место находить общие знакомства в совместных интересах, заводить, может быть, какие-то деловые связи. Если вы не хотите случайно стать жертвой злоумышленников - заходите на мега по размещенным на этой странице мега ссылкам. Жека 3 дня назад Работает! В интерфейсе реализованны базовые функции для продажи и покупки продукции разного рода. Проект запущен командой программистов, за плечами у которых разработка и запуск таких популярных проектов как LegalRC и Ramp. Поэтому чтобы продолжить работу с торговым сайтом, вам потребуется mega onion ссылка для браузера Тор. Она защищает сайт Mega от DDoS-атак, которые систематически осуществляются. Постараюсь объяснить более обширно. Вход mega store Сайт mega store: Сайт Mega store - это проект, созданный для поддержки и развития малого бизнеса в Даркнете. Рузиля Имангулова отлично! Александр Викторович. Что касается безопасности для клиентов, то они могут не беспокоиться, что их кинут на деньги, поскольку поставщики проходят многократную проверку, а все заказы проходят с независимым гарантом, предоставляющим свои услуги совершенно бесплатно. Виктор Прантенко До недавнего времени всё работало, но сейчас пишет о проблеме с подключением к прокси, к сожаленю. Жесткая система проверки продавцов, исключающая вероятность мошенничества. Mega darknet market - самый динамично-развивающийся маркетплейс в Даркнете. Если для вас главное цена, то выбирайте в списке любой, а если для вас в приоритете место товара и вы не хотите тратить много времени тогда выбирайте вариант моментальной покупки. В Mega store можно найти бизнес-идеи, инвестиционные предложения, вакансии, контакты, статьи, новости, полезные сервисы. В случае с Монеро дела обстоят совершенно иначе, да и переводы стоят дешевле.